-

Head defiant as India sense victory in first Australia Test

Head defiant as India sense victory in first Australia Test

-

Scholz's party to name him as top candidate for snap polls

-

Donkeys offer Gazans lifeline amid war shortages

Donkeys offer Gazans lifeline amid war shortages

-

Court moves to sentencing in French mass rape trial

-

'Existential challenge': plastic pollution treaty talks begin

'Existential challenge': plastic pollution treaty talks begin

-

Cavs get 17th win as Celtics edge T-Wolves and Heat burn in OT

-

Asian markets begin week on front foot, bitcoin rally stutters

Asian markets begin week on front foot, bitcoin rally stutters

-

IOC chief hopeful Sebastian Coe: 'We run risk of losing women's sport'

-

K-pop fans take aim at CD, merchandise waste

K-pop fans take aim at CD, merchandise waste

-

Notre Dame inspired Americans' love and help after fire

-

Court hearing as parent-killing Menendez brothers bid for freedom

Court hearing as parent-killing Menendez brothers bid for freedom

-

Closing arguments coming in US-Google antitrust trial on ad tech

-

Galaxy hit Minnesota for six, Orlando end Atlanta run

Galaxy hit Minnesota for six, Orlando end Atlanta run

-

Left-wing candidate Orsi wins Uruguay presidential election

-

High stakes as Bayern host PSG amid European wobbles

High stakes as Bayern host PSG amid European wobbles

-

Australia's most decorated Olympian McKeon retires from swimming

-

Far-right candidate surprises in Romania elections, setting up run-off with PM

Far-right candidate surprises in Romania elections, setting up run-off with PM

-

Left-wing candidate Orsi projected to win Uruguay election

-

UAE arrests three after Israeli rabbi killed

UAE arrests three after Israeli rabbi killed

-

Five days after Bruins firing, Montgomery named NHL Blues coach

-

Orlando beat Atlanta in MLS playoffs to set up Red Bulls clash

Orlando beat Atlanta in MLS playoffs to set up Red Bulls clash

-

American McNealy takes first PGA title with closing birdie

-

Sampaoli beaten on Rennes debut as angry fans disrupt Nantes loss

Sampaoli beaten on Rennes debut as angry fans disrupt Nantes loss

-

Chiefs edge Panthers, Lions rip Colts as Dallas stuns Washington

-

Uruguayans vote in tight race for president

Uruguayans vote in tight race for president

-

Thailand's Jeeno wins LPGA Tour Championship

-

'Crucial week': make-or-break plastic pollution treaty talks begin

'Crucial week': make-or-break plastic pollution treaty talks begin

-

Israel, Hezbollah in heavy exchanges of fire despite EU ceasefire call

-

Amorim predicts Man Utd pain as he faces up to huge task

Amorim predicts Man Utd pain as he faces up to huge task

-

Basel backs splashing the cash to host Eurovision

-

Petrol industry embraces plastics while navigating energy shift

Petrol industry embraces plastics while navigating energy shift

-

Italy Davis Cup winner Sinner 'heartbroken' over doping accusations

-

Romania PM fends off far-right challenge in presidential first round

Romania PM fends off far-right challenge in presidential first round

-

Japan coach Jones abused by 'some clown' on Twickenham return

-

Springbok Du Toit named World Player of the Year for second time

Springbok Du Toit named World Player of the Year for second time

-

Iran says will hold nuclear talks with France, Germany, UK on Friday

-

Mbappe on target as Real Madrid cruise to Leganes win

Mbappe on target as Real Madrid cruise to Leganes win

-

Sampaoli beaten on Rennes debut as fans disrupt Nantes loss

-

Israel records 250 launches from Lebanon as Hezbollah targets Tel Aviv, south

Israel records 250 launches from Lebanon as Hezbollah targets Tel Aviv, south

-

Australia coach Schmidt still positive about Lions after Scotland loss

-

Man Utd 'confused' and 'afraid' as Ipswich hold Amorim to debut draw

Man Utd 'confused' and 'afraid' as Ipswich hold Amorim to debut draw

-

Sinner completes year to remember as Italy retain Davis Cup

-

Climate finance's 'new era' shows new political realities

Climate finance's 'new era' shows new political realities

-

Lukaku keeps Napoli top of Serie A with Roma winner

-

Man Utd held by Ipswich in Amorim's first match in charge

Man Utd held by Ipswich in Amorim's first match in charge

-

'Gladiator II', 'Wicked' battle for N. American box office honors

-

England thrash Japan 59-14 to snap five-match losing streak

England thrash Japan 59-14 to snap five-match losing streak

-

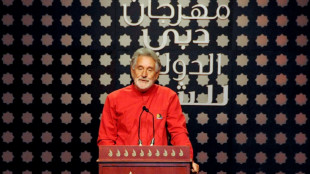

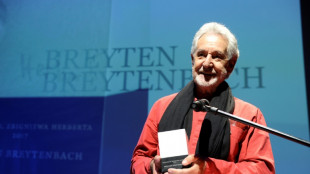

S.Africa's Breyten Breytenbach, writer and anti-apartheid activist

-

Concern as climate talks stalls on fossil fuels pledge

Concern as climate talks stalls on fossil fuels pledge

-

Breyten Breytenbach, writer who challenged apartheid, dies at 85

In Latin America, Brazilian fintech firms rule

When Brazilian sisters Daniela and Juliana Binatti quit their jobs to launch a new financial technology -- or fintech -- product, colleagues called them a pair of upstart nuts.

Alas, they ended up founding a company that US credit card giant Visa acquired this year for a cool $1 billion.

Pismo, as the firm these entrepreneurs created in 2016 is called, is the latest big success story of a Brazilian company in the fintech sector -- the one luring the most venture capital in Brazil and Latin America in general.

"When I was 16, my mother sent me out to leave my CV with banks along (the famous road) Paulista Avenue to find a job," said Daniela Binatti, who is 46 and grew up in a family of modest means in the megacity Sao Paulo.

Many of those same banks have now ended up becoming clients of hers.

With more than 450 employees and five offices around the world -- in Brazil, Britain, the United States, Singapore and India -- Pismo was acquired by Visa in June in one of the biggest deals yet in the Brazilian tech sector.

Brazil thus enlarged its herd of unicorns, or startups with a market value of at least $1 billion, to 21 out of a total of 38 in Latin America as a whole.

"Many people thought we were crazy," said Daniela Binatti, the company's director of technology.

She said she and her sister had to "break through a lot of prejudice to set up a Brazilian tech firm at an international level but we were convinced" it would succeed.

Pismo produces technology designed to make it easier for banks to launch card and payment products.

It will allow Visa to serve its customers no matter where they are or what currency they use, because Pismo's technological tools are based in the cloud and accessible from anywhere, Ricardo Josua, Pismo's executive director, said in a joint ad with Visa.

Other fintech companies created in Latin America's largest economy have shown growth potential, such as Nubank, one of the world's largest online banks, listing on Wall Street and with nearly 84 million clients; or Neon, another such bank, which in 2022 received a $300 million investment from the Spanish banking giant BBVA.

- An appealing ecosystem -

Pismo and its predecessors "show that Brazil is the region's ripest ecosystem for creating financial technology companies," said Diego Herrera, a specialist in the Connectivity, Markets and Finance Division at the Inter-American Development Bank.

Brazil, and in particular its fintech firms, lured 40 percent of the nearly $8 billion in venture capital that Latin America received in 2022, said LAVCA, the Association for Private Capital Investment in Latin America.

This is due mainly to the size of the Brazilian market, in which 84 percent of the adult population has a bank account in a country with 203 million people, said Eduardo Fuentes, head of research at an innovation platform called Distrito.

Brazil's outsized role in luring VC money also stems from the fact that just a few banks control this huge market, causing "many problems that entrepreneurs try to resolve," Fuentes added, citing high costs as an example.

What is more, "Brazil attracts international investors because it has skills and an environment favorable to innovation," said Fuentes, citing things like platforms for collective financing, payment institutions, and PIX, a revolutionary system for making small, instant payments.

Herrera said Brazil "is still the most attractive country in the region and keeps luring investment" even though the flow of money has dropped off from the record levels it hit during the pandemic, as the world economy slowed and interest rates rose.

- Opportunities -

There are 869 financial technology companies in Brazil, giving it eighth place in a global ranking in this category created by financial services company Finnovating.

Most of them focus on credit, payments and financial management, said Mariana Bonora, head of ABFintechs.

"Many opportunities arise in niches that are neglected" by traditional banks, such as products that serve people who are vulnerable or for entrepreneurs, Bonora added.

The online bank Cora -- seen as a possible unicorn -- seized on one of those niches to set up its business.

"We serve small and medium-sized companies, which account for more than 90 percent of all companies in this country, with lower costs and less red tape," said cofounder of Cora.

This Sao Paulo-based bank received $116 million in international funding during the pandemic, and boasts 400 employees and a million customers.

Looking ahead, Brazil hopes to consolidate its fintech ecosystem thanks mainly to the "open finance" system promoted by the country's central bank, which will facilitate exchange of data among institutions, said Herrera.

Other sources of innovation will be the regulation of crypto assets and the implementation of the digital real, the Brazilian currency.

T.Bondarenko--BTB